Real wealth is not about having a lot of money; it’s about having a lot of options to-

Choose not to go to office if ill

Choose work on your own terms

Choose to travel where and when you want

Choose say “no” without fear

Choose to spend more time with family

Choose your freedom you deserve

Our Amazing Partner

All leaders of the Industry

About INDGrowth

We would be lying if we said that we always cared deeply about finance, technology, or investments. Truth be told, those things are not particularly meaningful to us in or by themselves. What we, at INDGrowth, are passionate about is helping people live up to their fullest potential, becoming independent, giving them the choice to follow their passion by ensuring they have enough money.

Our Financial Distribution and Advisory business is simply the vehicle through which we can take these passions, apply them to the things that people need, and make a profit in the process. In other words, INDGrowth, our business firm, is our ‘Ikigai.’

We have a strong belief that tremendous wealth is going to be created in the next 10 years in India, when the economy moves from a $2.5 Trillion GDP to a $10 Trillion economy and the per capita income moves from $2000 to $8000.

We want to position INDGrowth as a personal CFO and a vehicle for family, friends, and associates to benefit from this wealth creation and take advantage of the “Chronological Lottery” this opportunity offers.

What We Offer

We offer simplified investment solutions to enable our clients achieve their financial goals. It gives us immense happiness when our clients feel delighted. Here are some of our core services

Goal based SIP

Goal based SIP

Tax Saving Mutual Fund

Tax Saving Mutual Fund

Retirement

Goal based SIP

Wealth Creation

Wealth Creation

Short Term Goals

Short Term Goals

Mutual Fund, Gold, Fixed Income

Gold & Fixed Income

Our Happy Clients!

Our Philosoply

Transparent, Holistic & Real

Brutally Honest with risk and reward

We embrace transparency as our guiding principle. We believe that financial decisions should be made with eyes wide open, fully aware of the risks and rewards. Our philosophy is simple: Brutal honesty is the foundation of trust.

Self-Care, Self-Wealth

We’re educators. Before you invest a single rupee, we’ll sit down with you, demystify financial jargon, and explain the intricacies of different investment avenues. Knowledge is power, and we empower you to make informed choices.

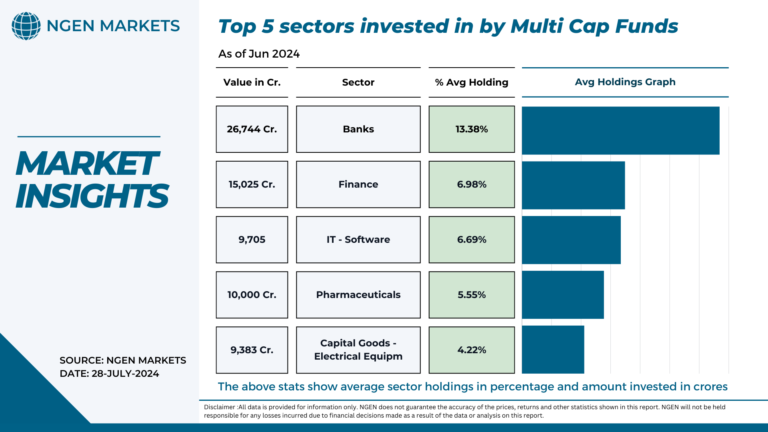

Diversification: Our Shield Against Market Storms

In the ever-shifting tides of financial markets, we stand firm on the shores of diversification. Our philosophy echoes through the winds of uncertainty, and it whispers: “Timing the market is a fool’s errand; diversify to thrive.”

Consistent Rebalancing & Review

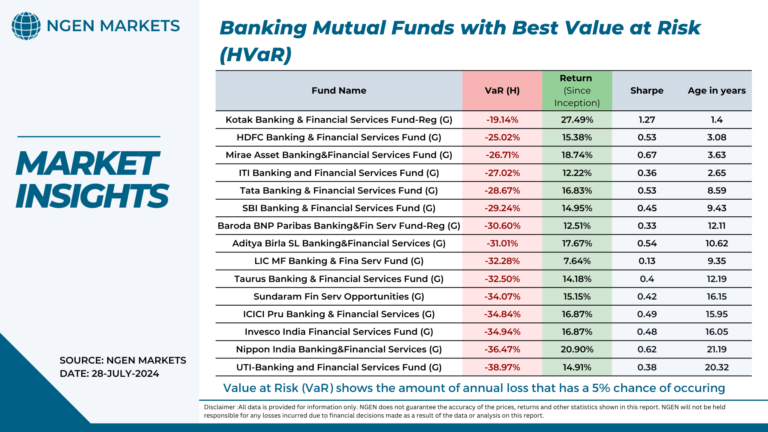

Our philosophy centered around consistent rebalancing, and review of portfolios. In today's dynamic and ever-changing market environment, adaptability is key. We understand that relying on speculation or gambling to make investment decisions is not sustainable. Instead, our approach is rooted in data-driven analysis.

FEATURES

Zero Paperwork

Seamless on-boarding, quick and simple

Monitor your Entire Portfolio

See your complete portfolio in a single place in a few clicks

Safe and Secure

Bank Grade Security

Zero Fees

We charge no commition from our clients

Assistance for Asset Allocation

Get customized Asset allocation as per need.

One Click Transaction

In just a click, you can invest or redeem in a hassle-free manner

SNAPSHOT

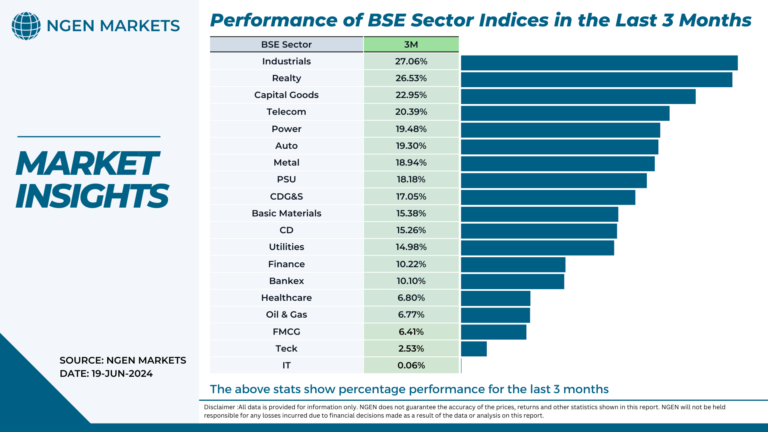

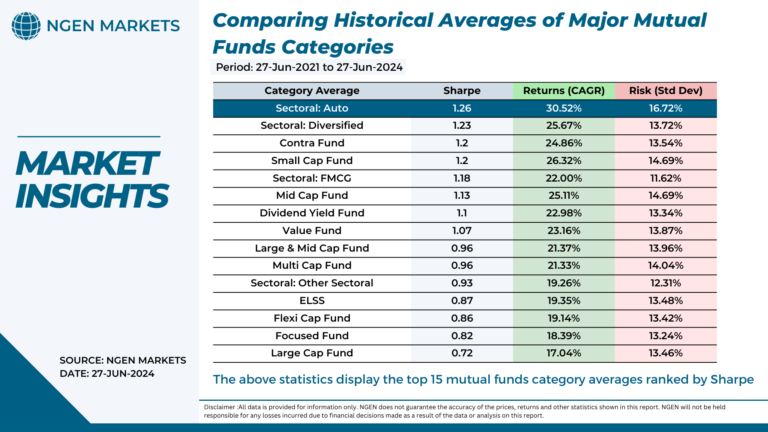

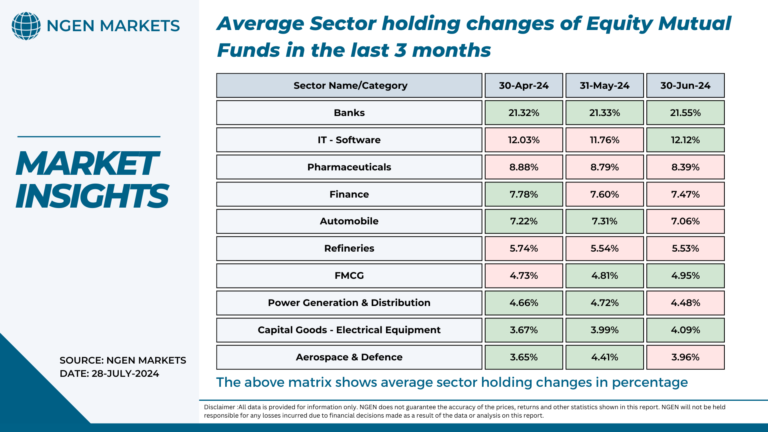

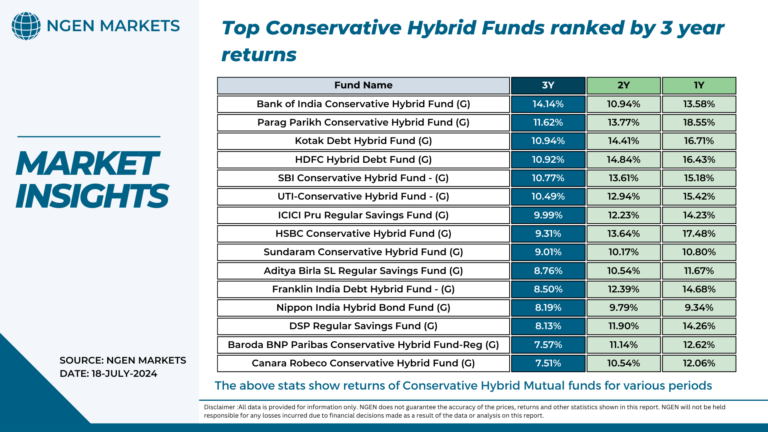

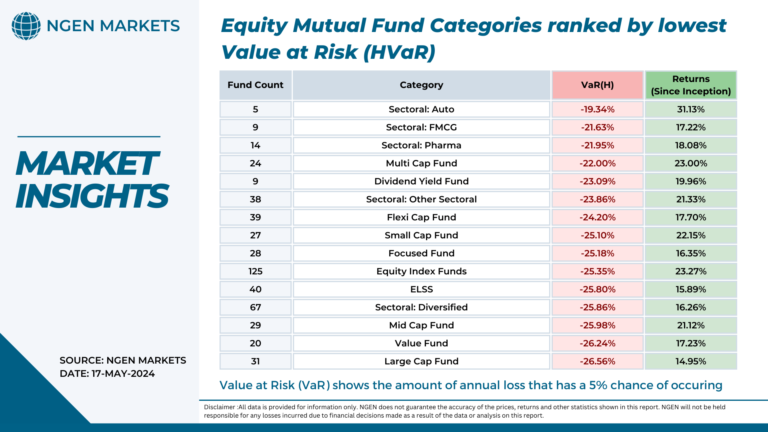

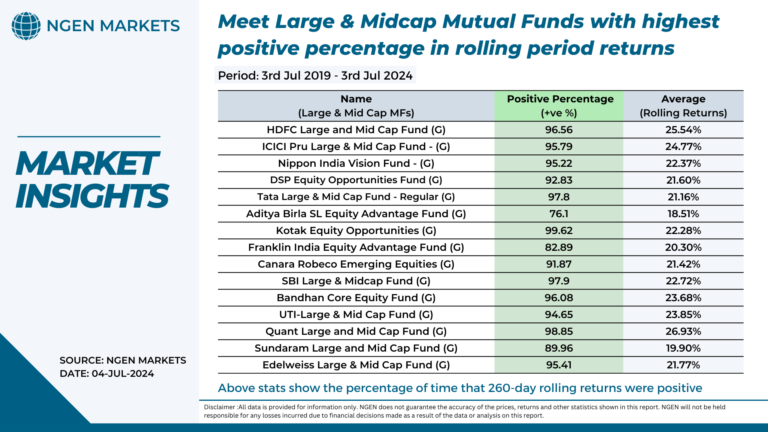

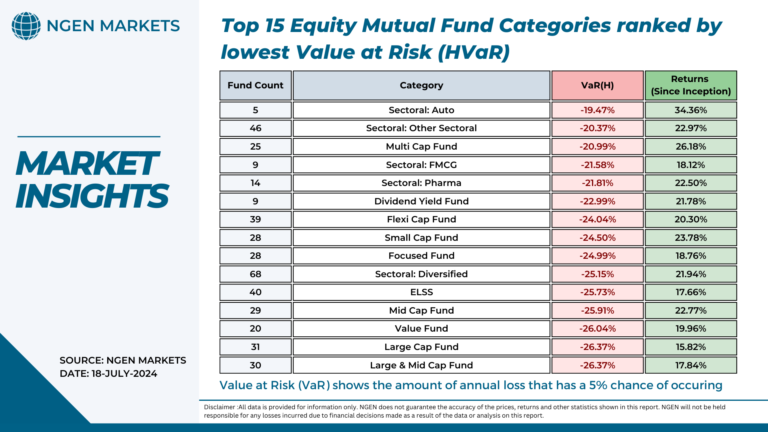

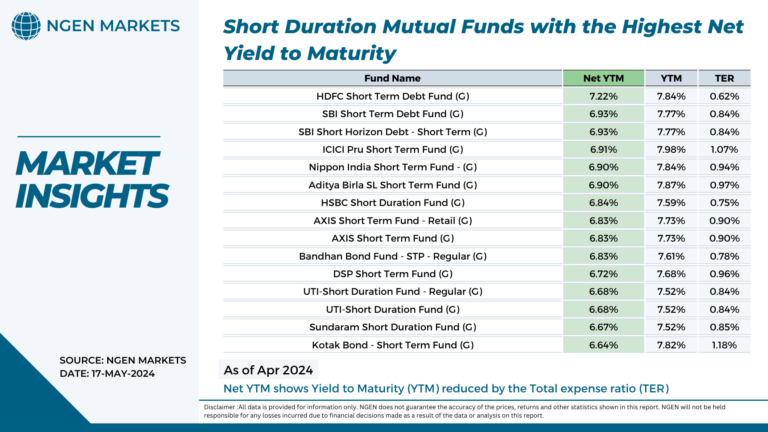

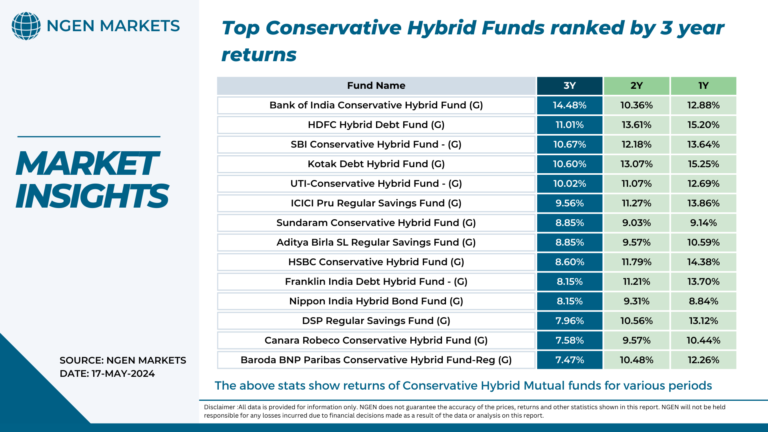

From Insights to Action: The Crucial Role of Data